Vischer advised FimmCyte, a Swiss biotech developing targeted immunotherapies for chronic fibro-inflammatory diseases, in connection with its research collaboration and option-to-license agreement with Gedeon Richter, a pharmaceutical company specialised in women’s health, with headquarters

Tags :dx3

Vischer advised Virometix, a clinical-stage biotechnology company developing fully synthetic vaccines, throughout completion of a $15m financing round from existing shareholders. The company will direct all proceeds from the round to supporting clinical and development

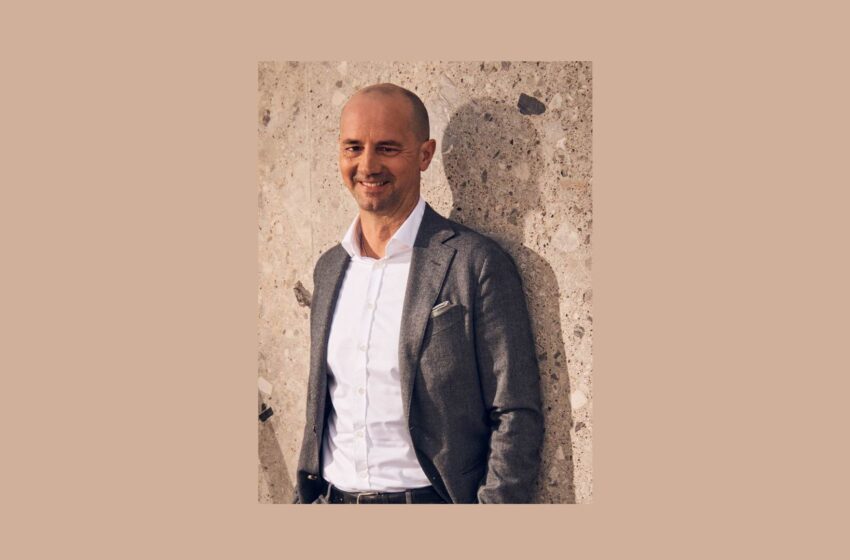

FGS Global bolsters its crisis communications and litigation communications team in Switzerland with the recent appointment of Jean-François Tanda (pictured) as managing director in Zurich. Prior to joining FGS Global, Tanda served as founding

Wenger Vieli represented JLL Switzerland in connection with its role as exclusive transaction advisor to the private selling part on the acquisition, by Post Immobilien, of a large commercial site in Schlieren (ZH). JLL Switzerland

Wenger Vieli advised the shareholders of Tofwerk on the company’s sale to Bruker, resulting in Bruker consolidating its ownership in Tofwerk to 100%. Headquartered in Thun, Switzerland, Tofwerk is a specialist ultra-fast time-of-flight mass spectrometry

Wenger Vieli advised Hoerbiger, a globally active technology group, on all Swiss legal aspects in connection with the acquisition of PI. Headquartered in Karlsruhe, PI is a provider high-precision motion and positioning solutions for

Schellenberg Wittmer advised Aggreko Holdings on its acquisition of MiT Energie Holding , a Swiss provider of mobile energy solutions and water damage restoration, active in the DACH-region. In connection with the deal, DLA Piper

Kellerhals Carrard advised P&F Immobilien on its internal reorganization and the subsequent sale of all shares in P&F Immobilien II to SFP Retail. The deal’s object, P&F Immobilien

Effective 1 January 2026, Borel & Barbey promoted Viviana Cibelli (pictured) to counsel. The profile Viviana Cibelli supports private and institutional clients across all areas of business law, with a particular focus to banking and finance

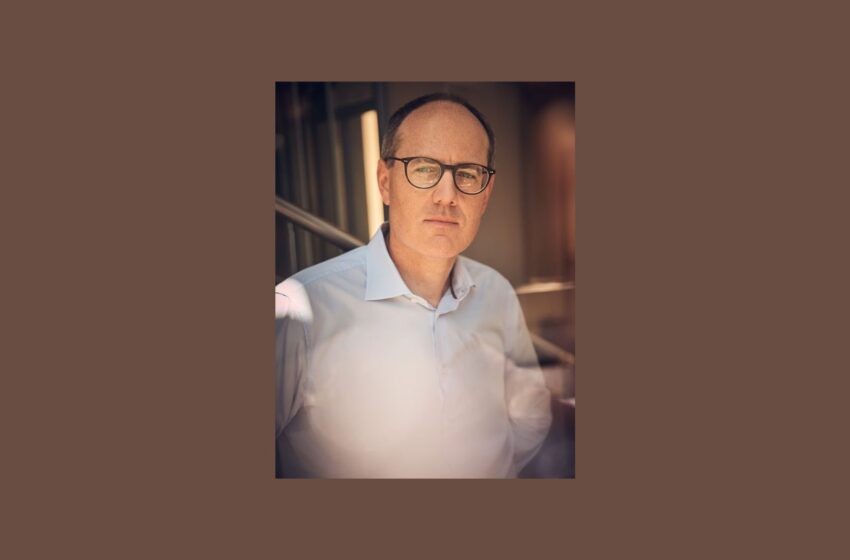

Loyens & Loeff Switzerland has promoted Zurich-based Gilles Pitschen (pictured) to the partnership. An expert in life sciences and healthcare M&A, Pitschen often represents international corporations, private equity and venture capital investors