Team.blue, a provider of AI-powered digital products and services for small and medium-sized busineseses, completed a strategic investment in Windsor Group, the operator of a Swiss AI-powered data integration and marketing attribution platform for

Tags :Wenger Vieli

Wenger Vieli represented JLL Switzerland in connection with its role as exclusive transaction advisor to the private selling part on the acquisition, by Post Immobilien, of a large commercial site in Schlieren (ZH). JLL Switzerland

Claret Capital Partners — a growth debt fund manager with a focus in technology, life sciences and climate tech companies across Europe — completed a strategic investment in Swiss medtech company SIS Medical. In connection with the

Wenger Vieli advised the shareholders of Tofwerk on the company’s sale to Bruker, resulting in Bruker consolidating its ownership in Tofwerk to 100%. Headquartered in Thun, Switzerland, Tofwerk is a specialist ultra-fast time-of-flight mass spectrometry

Wenger Vieli advised Hoerbiger, a globally active technology group, on all Swiss legal aspects in connection with the acquisition of PI. Headquartered in Karlsruhe, PI is a provider high-precision motion and positioning solutions for

Wenger Vieli advised Hoerbiger, a globally active technology group specialising in performance-defining components for several industries, in connection with the company’s acquisition of Karlsruhe-based PI, a high-precision motion and positioning solutions specialist. Pursuant to

Wenger Vieli advised vascular implants specialist Xeltis on its financing round, raising approximately EUR 50 million. The sum includes up to EUR 37.5 million from the European Investment Bank (EIB) and EUR 10 million from existing shareholders such

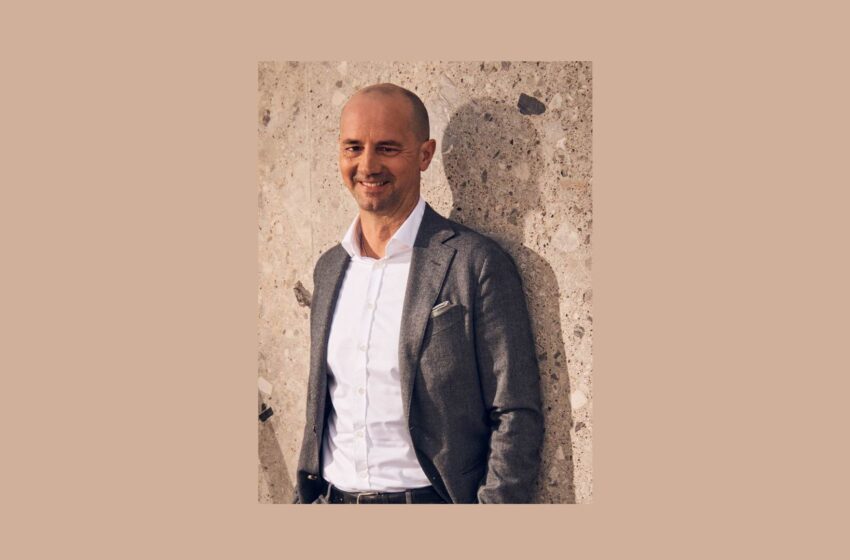

Wenger Vieli promoted Jonas Bühlmann (pictured) to the partnership, effective as of January 1st 2026. Part of the firm since 2021, Bühlmann is active within the areas of corporate tax, M&A tax and

Swiss life science and biotech company Arcoris Bio completed a CHF 6.3m seed financing round. In connection with the operation, Wenger Vieli advised Arcoris Bio, while MLL Legal represented German biotech investment fund Ventura Ace

Wenger Vieli advised DeepJudge, a Zurich-based specialist in legal AI platforms, throughout its USD 41.2 million series A financing round. Silicon Valley venture capital firm Felicis led the round in question, with further support from existing