Galderma Group AG , the pure-play dermatology category leader, has announced the launch of its Initial Public Offering on the SIX Swiss Exchange. According to various market sources and reports, the Skincare business is looking to

Tags :Lorenzo Togni

ABB has acquired the Swiss-based startup Sevensense Robotics AG (Sevensense Robotics). Founded in 2018 as a spin-off from the Swiss Federal Institute of Technology (ETH), Sevensense Robotics is a leading provider of AI-enabled 3D vision navigation

Nanogence closed its Series A financing round, securing financing from a consortium of investors. The consortium was led by CirCap, an investment platform providing strategic private capital to innovative companies in climate-tech, healthcare and education,

VectivBio Holding, a clinical-stage biopharmaceutical company pioneering novel transformational treatments for severe rare gastrointestinal conditions, and Ironwood Pharmaceuticals, a GI-focused healthcare company, announced that they had entered into an agreement for Ironwood to launch an

GAM Holding has entered into an agreement with Liontrust Asset Management relating to the launch by Liontrust of a public exchange offer for all publicly held shares in GAM. As further set out in the

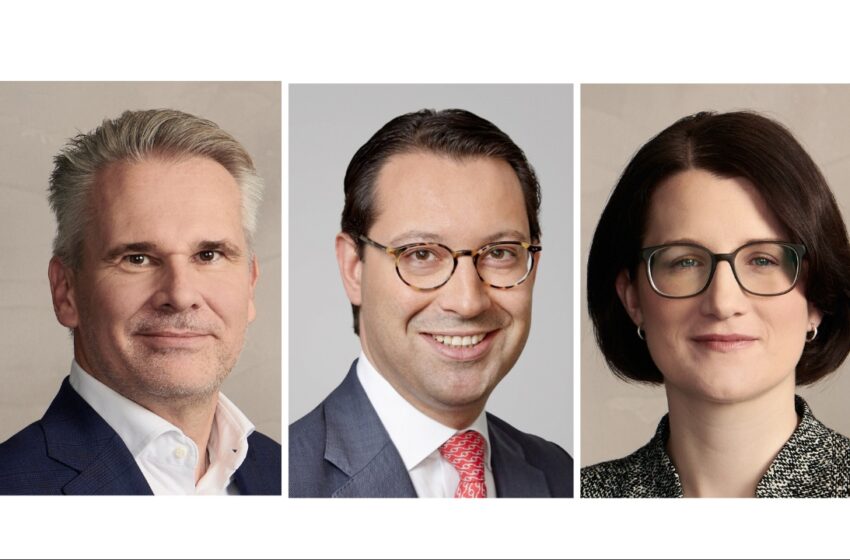

Homburger appointed Lorenzo Togni to its partnership and Bénédict Thomann joins the firm as counsel. Lorenzo Togni (pictured right) joined Homburger in 2016. He specialises in equity capital markets, focusing on IPOs, with a

On Holding, a Swiss-based athletic shoe and performance sportswear company, has completed its initial public offering (IPO) on the NYSE, consisting of an offering of 31,100,000 Class A ordinary shares, of which 25,442,391 were offered by On

Molecular Partners, a clinical-stage biotech company, announced the pricing of its Initial Public Offering of 3,000,000 American Depositary Shares (ADS) in the United States at a public offering price of USD 21.25 per ADS, for total gross

PolyPeptide Group AG, a global operator in peptide development and manufacturing, successfully priced its initial public offering (IPO) at CHF 64 per share, implying a market capitalization of CHF 2.12 bn. The base offering of the IPO

Homburger acted as legal counsel to the managers on this transaction with respect to all aspects of Swiss law. The team comprised partner Dieter Gericke and associate Lorenzo Togni (both Corporate / M&A, Capital Markets).