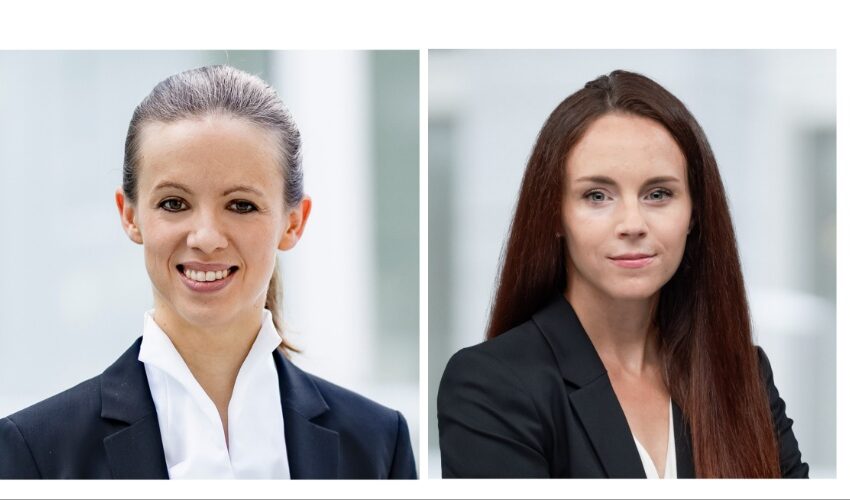

Wenger Vieli has announced the appointment of Sophia Hartwig (pictured on the left), Yannic Lütolf (pictured on the center), and Dominique Mattmann (pictured on the right) to the position of senior associates. Sophia Hartwig

Tags :sx1

Walder Wyss has advised the buyer of the Park Hyatt Zurich. It is a joint partnership among Trinity Investments, funds managed by Oaktree Capital Management, and funds managed by UBS Asset Management. The joint partnership

The Swiss dental startup Odne has raised USD 5.5m to fund the upcoming US market launch for their minimal invasive Root Preservation Technology (RPT). The Series A1 round for Odne, was led by Revere Partners (

Swiss Prime Site has successfully placed green bonds in the aggregate principal amount of of CHF 250 million 1.80% due 2030. The bonds were issued by Swiss Prime Site Finance AG

Kinarus Therapeutics Holding AG (“Kinarus”) and Curatis AG (“Curatis”), announced they have signed a binding agreement to combine their businesses, by way of an exchange of Curatis shares

The Swiss company DXT Commodities, has won a litigation case before the Court of Milan. The company had been accused of nullifying contracts related to electricity prices. The case was brought by one of the

Niederer Kraft Frey has advised Bertrand Piccard and Climate Impulse on the project set-up and partnership agreement with Syensqo. After achieving the first circumnavigations of the globe in a balloon and more recently in a

Niederer Kraft Frey advised the banking consortium led by Commerzbank Aktiengesellschaft, ING Bank, a branch of ING-DiBa AG, Landesbank Baden-Württemberg, Stuttgart, and UniCredit Bank AG acting as lenders, on term and multicurrency revolving credit

Credit Mutuel Equity is partnering with somnOO to support the expansion of their hotel portfolio and management platform. This includes providing growth capital and allowing somnOO’s management team to take a stake in the

Solör Bioenergy Group´s main shareholder, Nordic Infrastructure AG, successfully completed the first close of €215m Green Mezzanine Debt Facility. Solör Bioenergy Group is a leading energy company in the Nordics for wood-based