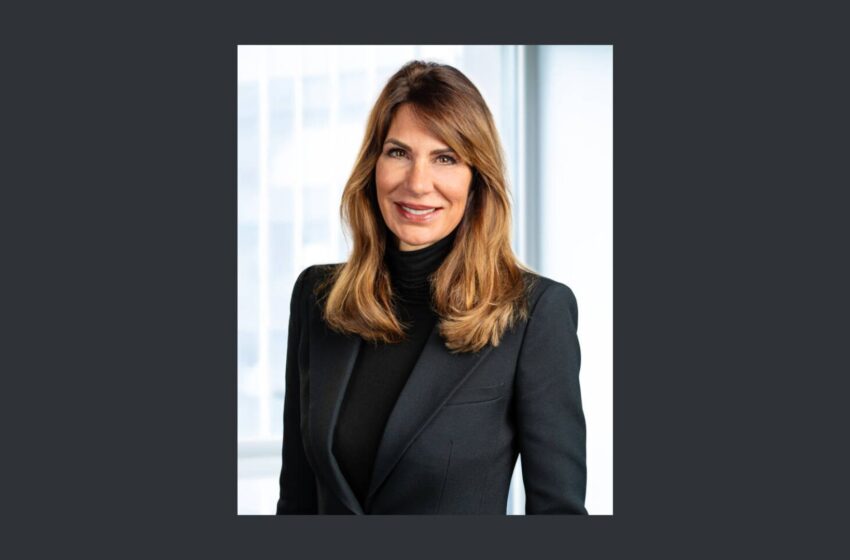

Baker McKenzie Switzerland has promoted Diana Bellido Gomes (pictured) to partnership in Geneva, effective 1 July 2025. Bellido Gomes will bolster the Firm’s Global Reorganizations and Mergers & Acquisitions Practice Groups in the city. Moreover, she

Tags :sx3

Effective 1 July 2025, Andreas Bohrer will cover the newly created role of Chief Legal & Corporate Affairs Office at Lonza, a Basel-based healthcare manufacturing company. Moreover, Bohrer will become a member of the company’s Executive

As of May 1 2025, Charles Russell Speechlys promoted British lawyer Elena Dunn (pictured) from senior associate to counsel in Zurich. The profile A UK solicitor with over 11 years of experience, Elena Dunn advises an international clientele

On April 1st 2025, Déborah Carlson Burkart (pictured) joined Eversheds Sutherland as the firm’s new Of-Counsel in Bern, moving from Wernli Rechtsanwälte. Burkart’s legal experience spans the areas of corporate law, corporate

As of March 2025, Ferdinand Winter (pictured) has been appointed General Counsel of Ten23 health, a Swiss pharmaceutical contract development and manufacturing organization. Moving from Hansa Biopharma, Sweden, Ferdinand will be responsible for establishing and leading

Bär & Karrer advised HAS Healthcare Advanced Synthesis and its sole shareholder in the acquisition of Chemholding due and its subsidiaries, including its main operative company Cerbios-Pharma. The company HAS Healthcare Advanced Synthesis is

Bär & Karrer advised Axpo Holding AG in connection with the purchasing of an additional 4.6% of shares in CKW AG from Anna Holding AG. The transaction in question expands Axpo Holding AG’s stake

Bär & Karrer advised private equity firm PAI Partners in the proprietary partnership for hospitality company Motel One Group. The context Founded in 2000, Munich-based hospitality chain Motel One currently operates 96 hotels with 27,223 rooms. Pursuant

MME advised Winterberg Group and Healthcare Holding on the acquisition of Dental Axess by Mikrona Group . The context Headquartered in Zug, private equity firm Winterberg Group focuses on high-grwoth-potential companies integrated into platform structures. The

Walder Wyss advised American translation and language services company TransPerfect throughout its acquisition of Apostroph Group, a Switzerland- and Germany-based language service provider (LSP). The context In connection with the deal, TransPerfect expands its yet